FI Toolkit

Description and Screenshots

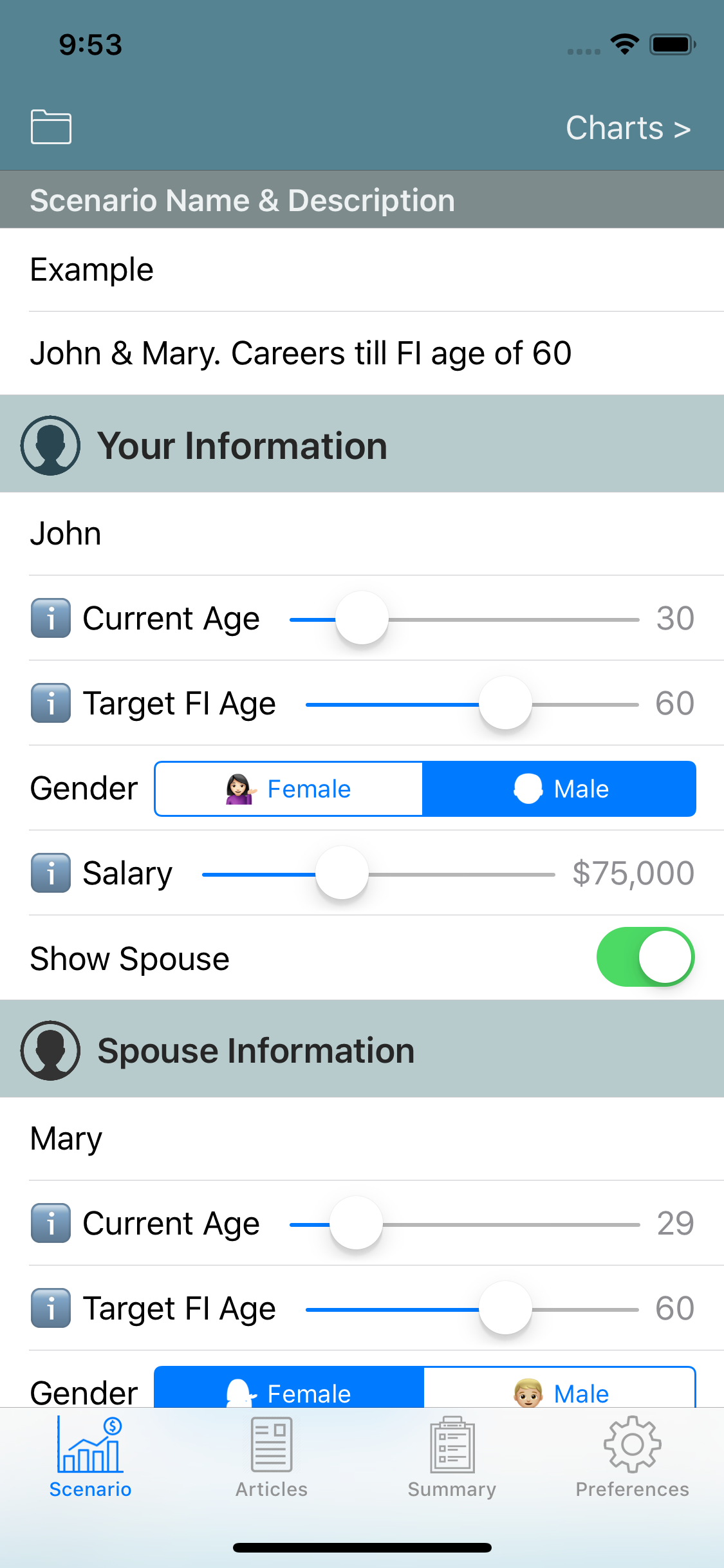

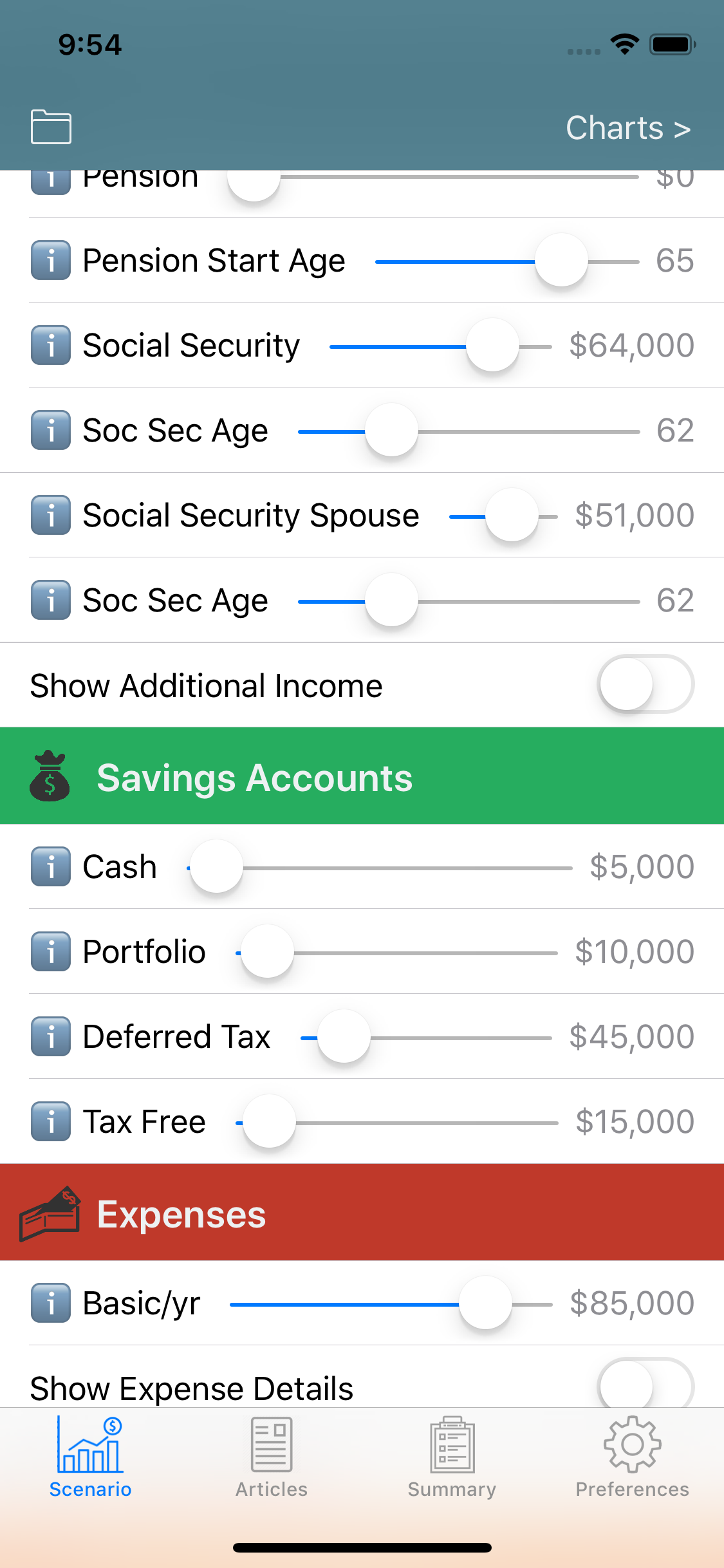

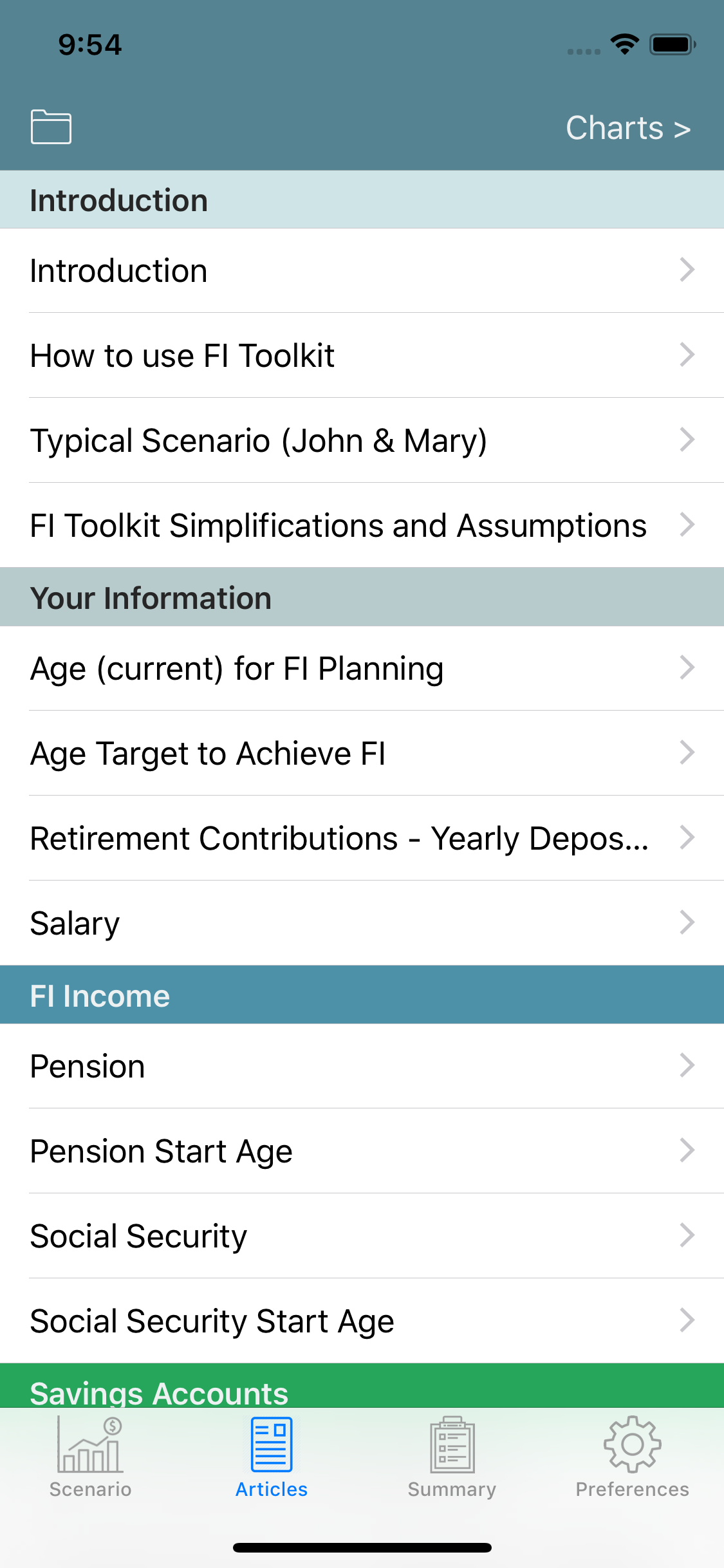

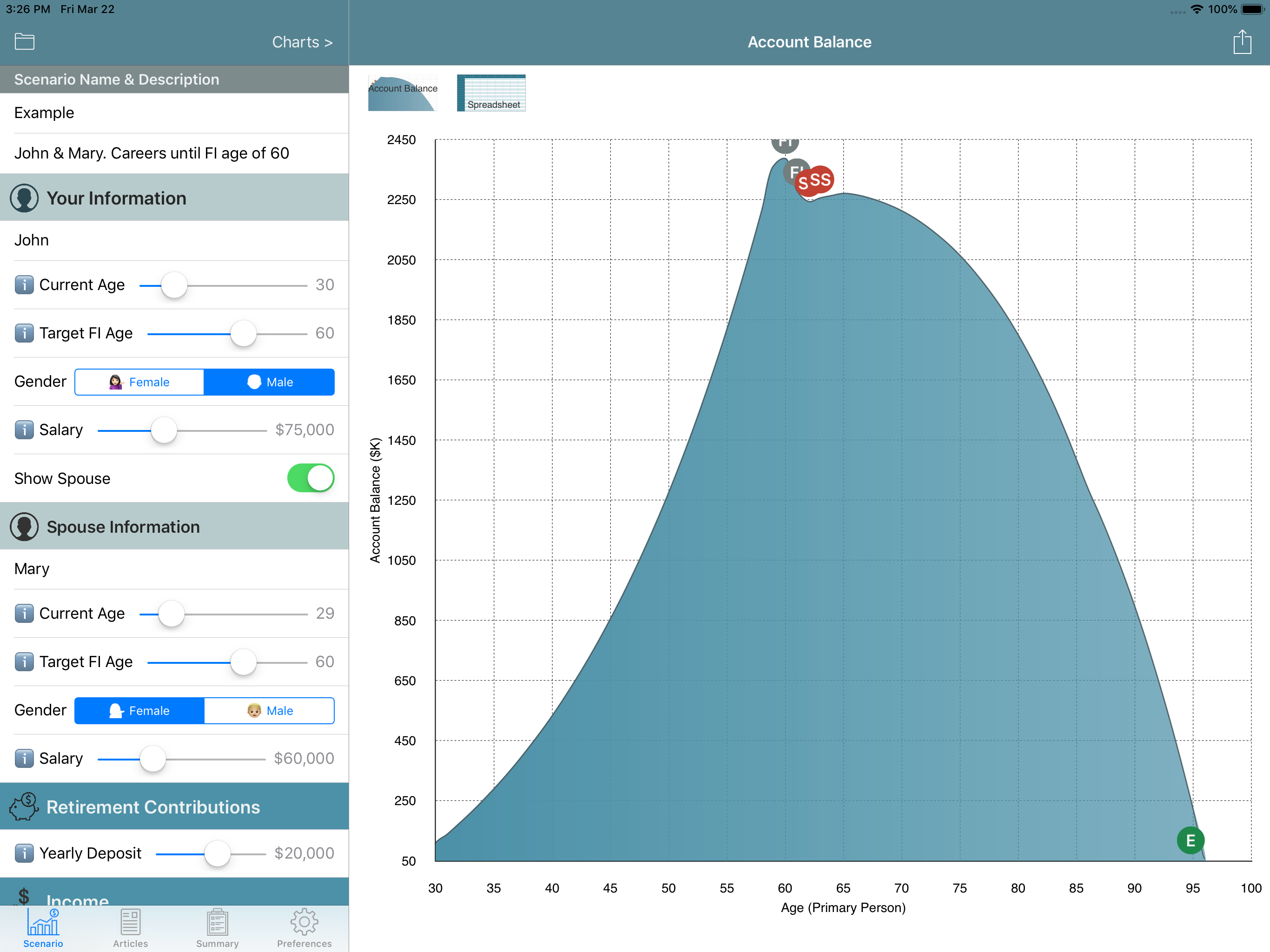

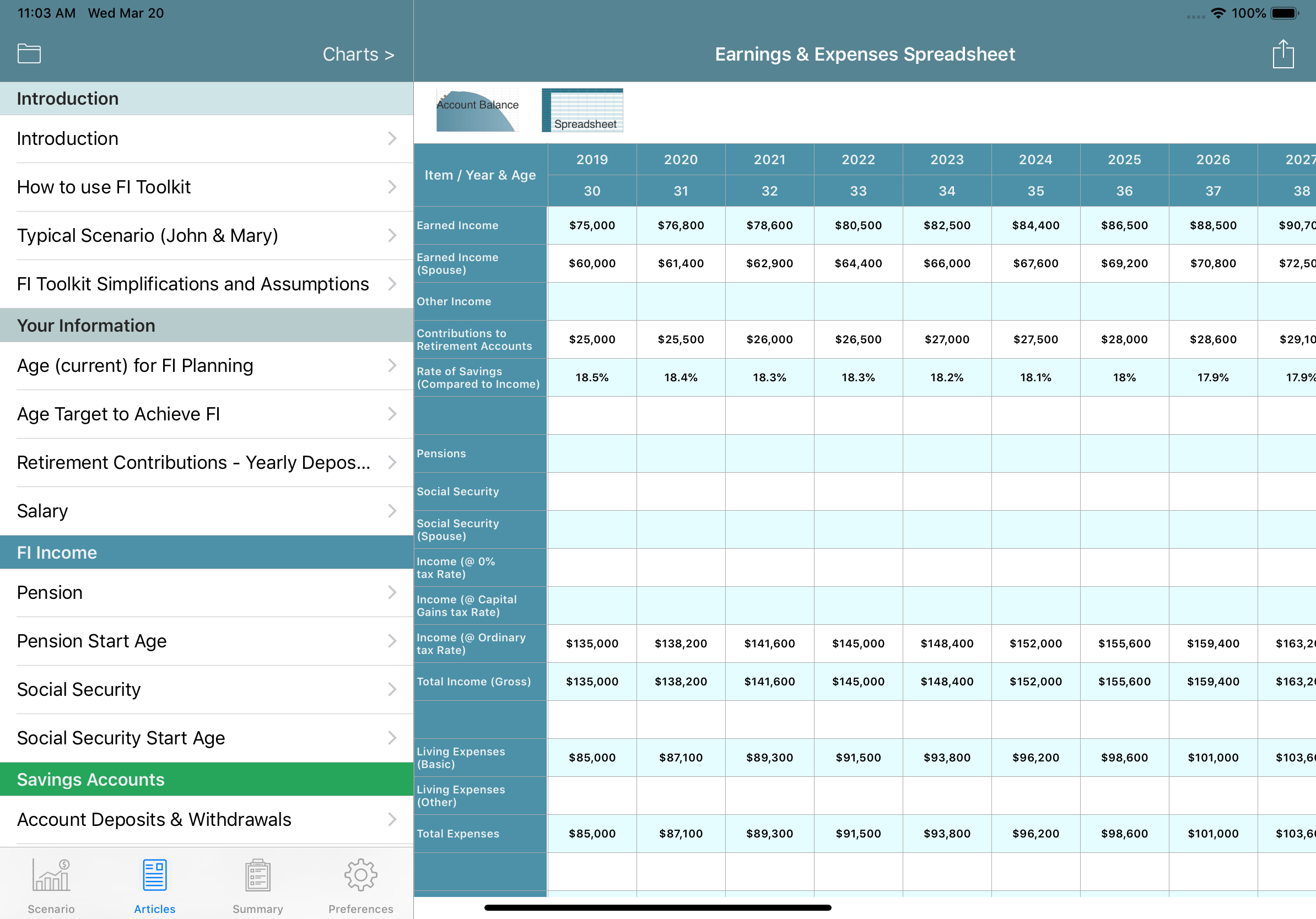

| Introduction Welcome to FI Toolkit, your doorway to achieving Financial Independence (FI). With the help of this application, you will be exploring the basic principles of planning for your financial future. You will be able to analyze your current financial situation, make adjustments for real-time plan results, and construct alternate scenarios with projected future outcomes. Information articles will explain the application inputs and their financial significance in the pursuit of FI. And, where applicable, commentary and advice about the pursuit of FIRE Financial Independence Retire Early, will also be offered. Financial Independence starts with saving,.. early and often. How quickly FI can be achieved depends on the savings available from your earnings minus your expenses, and the compounding interest of these savings. FI Toolkit allows you to enter your salary and retirement contributions that increase in future years leading up to your anticipated FI age. The reasonable control of expenses for your particular lifestyle is a huge part of being able to continue saving or having the ability to save anything at all. You must evaluate your spending habits and answer basic questions regarding your now lifestyle vs your future lifestyle of freedom and security offered by being Financial Independent. FI Toolkit provides a means to define your current basic and discretionary expenses and project those basic expenses into future years. Once FI is achieved, it needs to last well into retirement. Your post-FI income and your projected expenses will determine how long your nest-egg will last. FI Toolkit allows you to define your post-FI income and future discretionary expenses (among other things) which are then used in projecting total cash flow until your savings is exhausted. Screenshots (iPhone XS)

Screenshots (iPad Pro)   |